In a remarkable feat of modern physics, scientists at the Large Hadron Collider have managed to recreate one of humanity’s oldest fantasies: turning lead into gold. By smashing lead atoms together at near-light speeds, the resulting collisions generate immense heat and energy — conditions so extreme that they momentarily produce a flurry of exotic particles and even atoms with the same number of protons as gold. Could it be that the alchemists’ long-elusive dream — transmuting the worthless into the sublime — has at last been realized? And not in cluttered stone laboratories thick with incense and delusion, but in the sleek, humming vacuum tubes of a particle collider hidden miles under the Swiss Alps?

But there’s a catch: these gold-like nuclei exist for only the tiniest sliver of time — less than a millionth of a second — before they decay or transform into something else. They don’t last long enough to form stable atoms, much less shiny gold bars. That’s because what’s being created in these collisions isn’t ordinary, stable gold. Instead, these are unstable isotopes — nuclei that may contain 79 protons (which defines gold) but often the wrong number of neutrons, or too much internal energy to hold themselves together. Lacking the necessary stability, and with no time to capture electrons and form full atoms, these proto-gold particles quickly disintegrate into other elements or radiation. It’s an awe-inspiring display of physics at the edge of possibility, but it’s a far cry from the practical transformation of lead into gold dreamed of by ancient alchemists.

But what if that limitation could somehow be overcome? What if science unlocked a way to create gold that didn’t vanish — gold that was stable, persistent, and reproducible? Thousands of years of mystical yearning, from Egyptian priests to Renaissance alchemists, might suddenly be realized in a laboratory. Let’s conduct a gedankenexperiment — a thought experiment — to explore what might happen if the ancient dream finally came true.

The Physical Limitations

The first step in our thought experiment must be a sober look at the costs and logistics of artificial gold creation. Producing an ounce of gold through nuclear transmutation — whether in particle accelerators or hypothetical future reactors — would currently require astronomical energy input. High-speed collisions between heavy nuclei demand immense power, cryogenic cooling systems, rare materials, and highly specialized infrastructure. Even if science finds a way to stabilize the gold nuclei created in such collisions, the process remains incredibly inefficient: billions of collisions might yield only a few atoms of usable gold. Time is another factor — each collision and its byproducts must be precisely controlled and monitored, which means even producing milligrams of gold could take days or weeks under constant operation.

In contrast, modern gold mining — while environmentally and socially fraught — is relatively cheap per ounce when spread over large-scale operations. Open-pit mines and chemical leaching processes can yield ounces of gold at a cost ranging from hundreds to low thousands of dollars, depending on geology and location. Artificial synthesis, by comparison, could run into the tens of millions of dollars per ounce at current technology levels. Additionally, there are safety considerations: working with high-energy particle beams, radioactive decay products, and precision instrumentation carries serious physical and radiological risks. Before the fantasy of lab-made gold can be treated as a practical alternative to mining, these profound differences in cost, time, energy, and danger must be reconciled — or radically improved.

A critical challenge in our thought experiment is scalability. Even if stable gold could be produced artificially, the infrastructure needed to do so at meaningful volumes would be staggering. Unlike mining operations — which have evolved over centuries to exploit rich deposits efficiently — nuclear synthesis requires highly specialized facilities, vast amounts of energy, and delicate precision. Producing even a few ounces would likely involve multiple synchronized particle accelerators or advanced reactors, none of which currently exist for that purpose, and whose construction and maintenance would carry prohibitive costs.

Equally important is the issue of purity and isotopic composition. Naturally occurring gold is made almost entirely of one stable isotope, Au-197, prized for its inertness and consistency. Lab-synthesized gold, on the other hand, might contain unstable isotopes or trace levels of radiation, making it unsuitable for use in jewelry, electronics, or central bank reserves without extensive and expensive purification. If artificial gold couldn’t meet the same metallurgical standards as mined gold, it would remain a scientific novelty rather than an economic competitor.

Taken together, these tradeoffs suggest that while artificial gold creation might be scientifically fascinating, it is currently far from commercially viable. The promise of alchemical transformation still faces massive practical, technical, and economic barriers before it could rival — or even supplement — the ancient practice of pulling gold from the earth.

Clues from the Past

With those parameters in place, let’s now turn our attention to historical analogies that might provide a template for this sort of change. There are a few past examples where commodities once considered precious, strategic, or culturally essential became suddenly abundant, obsolete, or economically irrelevant due to scientific or technological breakthroughs. These cases help build a mental model for the potential disruption of gold — but they also come with limitations. Most lacked the deep monetary, psychological, and geopolitical entrenchment that gold possesses today.

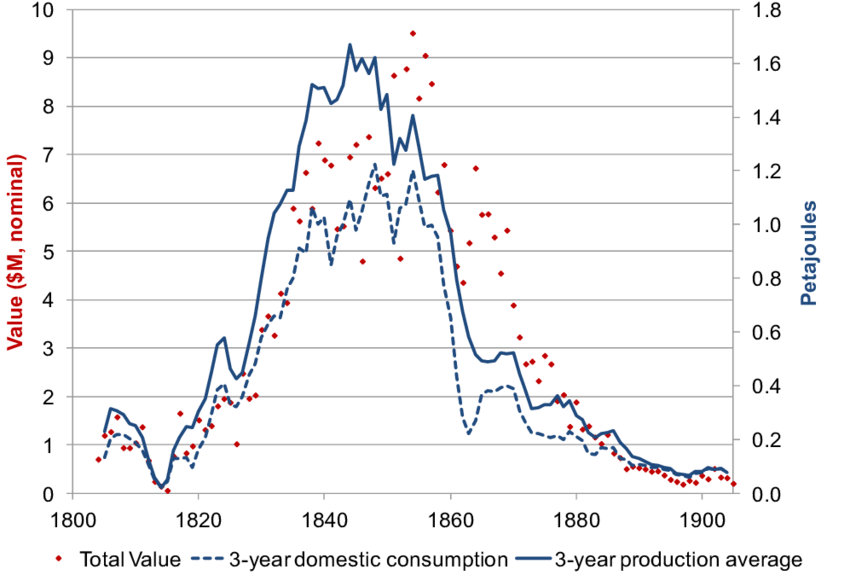

Whale Oil → Kerosene & Petroleum

In the 18th and early 19th centuries, whale oil was a prized commodity, used primarily for lighting. Entire coastal economies, particularly in New England, depended on the dangerous and labor-intensive whaling industry. This changed rapidly with the invention of kerosene and the discovery of petroleum in Pennsylvania in 1859. These alternatives were cheaper, more scalable, and didn’t rely on dwindling whale populations. As demand plummeted, the whaling industry collapsed, leading to economic decline in towns that had thrived on maritime oil. Meanwhile, petroleum-rich regions saw a surge in economic activity, and artificial lighting became vastly more accessible, democratizing productivity after dark.

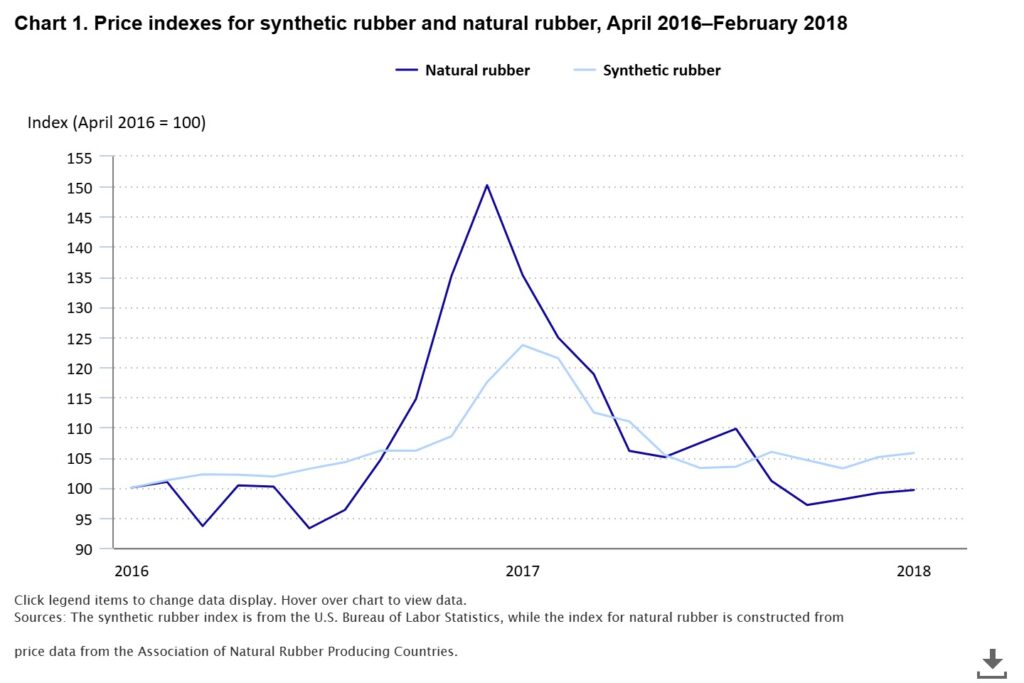

Natural Rubber → Synthetic Rubber

Natural rubber was once a strategic resource, essential to industrialization and modern warfare. It came almost exclusively from Amazonian and Southeast Asian plantations, giving colonial powers immense leverage. During World War II, synthetic rubber was developed using petrochemicals to meet military demands when access to natural rubber was cut off. Postwar, synthetic rubber production continued to expand, gradually displacing natural rubber in many uses. While not rendered obsolete, natural rubber lost its monopoly and strategic cachet. Its pricing and geopolitical significance diminished, replaced by flexible global production chains centered around chemistry, not trees. Both, however, are still in use, with the price of synthetic rubber more closely correlated with world oil prices than the natural variety.

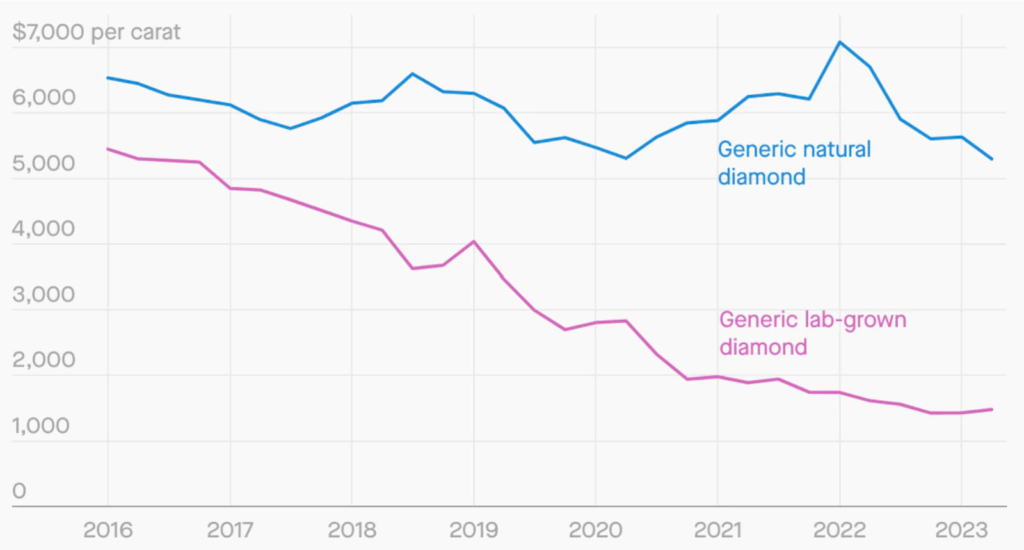

Diamonds → Lab-Grown Disruption

Though diamonds were never a standardized monetary asset like gold, they carried immense cultural, emotional, and sometimes financial weight. The commercialization of lab-grown diamonds through HPHT and CVD processes has led to a sharp divergence in price: lab-created stones have dropped 60–90% in value since 2016. Traditional players like De Beers initially resisted but now sell lab diamonds at lower prices to preserve the premium of natural stones. Gen Z consumers increasingly favor lab-grown options for their affordability and ethical advantages, undermining the mystique of “real” diamonds. Industrially, lab-grown diamonds dominate — over 99% of the market — due to cost and versatility. As a result, investment demand has nearly vanished, and resale value is highly uncertain. In contrast to gold, diamonds had no universal standard or role in reserves, but their fate suggests that once scarcity is replicable, long-term value erodes — especially if emotional or cultural ties are weak.

Let’s assume all the economic hurdles are overcome — and yes, pun gently set aside, atom-smashing gold pans out: Let’s further suppose that our historical paradigms are generally representative. What would some of the knock-on effects be if stable, abundant lab-made gold became a reality?

Short-Term Implications (0–6 months)

If stable, artificially created gold were suddenly viable, the immediate impact would be financial chaos. Gold prices would collapse almost overnight — possibly falling 50 to 80 percent — as investors and institutions dumped physical holdings and gold-backed ETFs in a panic. The psychological shock alone would trigger a rush for alternative stores of value, briefly sending silver, platinum, and palladium soaring. However, those rallies would be volatile and short-lived: if gold can be synthesized in a hadron collider, then silver, platinum, and palladium — each just a handful of protons and neutrons away in atomic mass — are well within striking distance in the nuclear transmutation landscape. Exchange rates would shift as well: gold-exporting countries like Ghana and Russia would see their currencies depreciate sharply, while commodities priced in gold would become erratic. Cryptocurrencies — particularly Bitcoin — might rally as narratives of engineered scarcity and digital permanence gained new urgency. Central banks with large gold reserves would suffer paper losses and balance sheet distress, while economies reliant on gold exports would experience swift and painful current account shocks.

Medium-Term Implications (6 months–2 years)

Within a year or two, the gold price would stabilize at a new, dramatically lower level — likely just above the marginal cost of artificial production unless its output were somehow tightly regulated. Gold’s historic monetary premium would vanish, and it would lose much of its investment allure. Meanwhile, industrial and luxury demand would shift: if synthetic gold proved unsuitable for high-end jewelry or electronics, demand for purer natural metals like platinum or rhodium might recover. The broader monetary landscape would begin to change, with central banks rethinking reserve strategies and looking beyond gold for hedging purposes. Assets like real estate, art, or crypto would likely absorb capital formerly allocated to gold. The mining sector would be reshaped: gold mining operations would collapse, equities in major gold producers would plummet, and investment would flood into other extractive industries with growth potential, such as lithium and rare earths.

Long-Term Implications (2 years and beyond)

Over time, gold would be reclassified as an industrial or luxury commodity rather than a monetary asset. Like copper or nickel, it would be valued for its physical properties but no longer serve as a hedge or store of value. Its role in central bank vaults would fade, replaced by alternative assets — potentially crypto, digital commodities, or even algorithmically scarce instruments designed for monetary roles. Countries that had hoarded gold, like China or Germany, would lose strategic leverage, while those pioneering and controlling synthetic gold technologies could rapidly see geopolitical ascendance. More broadly, the event would force a philosophical and economic reckoning: scarcity, once tied to the natural world, would become a question of code, governance, and confidence. Trust in tangible wealth would erode, prompting a shift toward engineered forms of scarcity, permanently altering how value and stability are perceived in global finance.

Other Effects Over Varying Time Frames

Beyond financial markets and central bank policies, the artificial creation of stable gold would ripple outward into nearly every corner of the global economic and geopolitical order. Gold-backed monetary frameworks — including symbolic or partially collateralized systems promoted by BRICS or envisioned in alternative trade settlements — would unravel overnight. Even proposals for gold-linked stablecoins or a new Bretton Woods-style regime would become instantly obsolete, stripping credibility from monetary systems premised on natural scarcity. The psychological blow would be just as profound: gold has long symbolized permanence and intrinsic value. If it suddenly became synthetic and plentiful, it could shake confidence not only in gold but in other physical stores of value, prompting a cultural pivot toward digital assets, intellectual capital, or algorithmically enforced scarcity.

The political and societal consequences would be no less destabilizing. Many developing nations depend heavily on gold exports to fund government budgets and maintain social cohesion. A collapse in gold’s value could drive unemployment, fiscal crises, and even regime change in politically fragile states. Meanwhile, cultural norms would be disrupted: in countries like India, where gold is deeply tied to weddings, dowries, and social status, abundant synthetic gold could democratize jewelry access but also undermine centuries-old traditions. At the same time, nations that control or lead in artificial gold production would gain a new kind of strategic leverage — akin to mastering uranium enrichment or dominating semiconductor supply chains. Industries that revolve around gold’s physicality — vaulting, bullion transport, and gold-backed lending — would face obsolescence or radical transformation. And inevitably, such a paradigm shift would provoke a wave of conspiracy theories and populist backlash, with claims that global elites orchestrated the disruption to destroy sovereignty, wealth preservation, or traditional monetary values.

Although we’ve taken a small step closer, true alchemy — whether in the historical sense of chemical transmutation or the Star Trek-style replicator fantasy — is still a long way off. Yet as history shows, when scarcity collapses, so too can the systems built upon it — economic, political, and cultural alike. From whale oil to diamonds, once-prized commodities have been dethroned by technological advances, often with far-reaching consequences. If gold is next, the ripple effects could redefine our concepts of value, trust, and stability. Whether this transformation brings prosperity or disruption will depend not just on science, but on how wisely we respond. As with all Schumpeterian creative destruction, disruption at the elemental level in the world of commodities will bring both upheaval and opportunity.