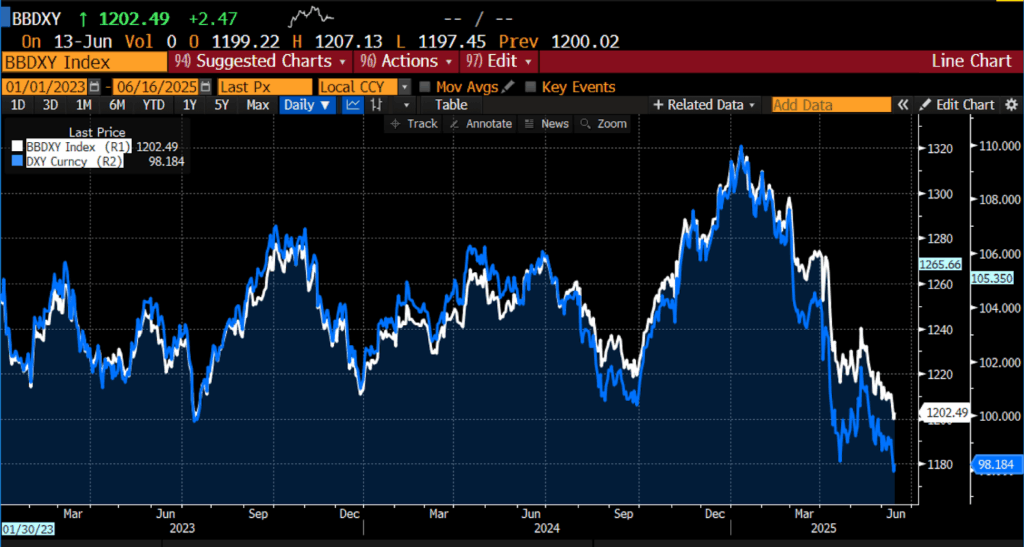

The recent weakness in the US dollar has reignited the debate over the durability of the dollar’s dominance in global finance. Over the first half of the year, the Bloomberg Dollar Index has fallen nearly 8.5 percent, marking one of the sharpest declines since the mid-1980s. Yet while this drawdown has fueled widespread commentary about de-dollarization, it is important to distinguish between dollar weakness — a familiar, cyclical phenomenon — and the far more consequential and complex issue of de-dollarization, which concerns the dollar’s standing as the world’s primary reserve currency and medium of international exchange.

Bloomberg Dollar Spot Index & US Dollar Index Spot Rate, 2023- present

The current period of dollar weakness is rooted in several overlapping forces. Since Donald Trump’s return to the White House, aggressive trade policies, escalating tariff conflicts, and sharp reversals in longstanding diplomatic and economic norms have unnerved international investors. The dollar index has fallen nearly nine percent since inauguration, the worst such performance since the 1971 Nixon shock, when the US severed the dollar’s convertibility to gold. Bank of America’s fund manager surveys indicate that bearish sentiment toward the dollar is at its highest level since 2006, while foreign appetite for US assets — particularly Treasurys and equities — has declined meaningfully, with foreign ownership of Treasurys falling to 32.9 percent as of late 2024.

Simultaneously, the fiscal position of the United States has worsened considerably. The Trump administration’s substantial tax cuts and growing entitlement obligations are threatening to push deficits to alarming levels, while rising interest costs on government debt threaten long-term fiscal stability. These dynamics are now feeding into market pricing and investor expectations. With global capital increasingly reluctant to finance Washington’s deficits on previous terms, foreign inflows into dollar-denominated assets have moderated. Many foreign investors, particularly from Europe, are in a sustained “buyers’ strike” on US assets, compounding downward pressure on the dollar.

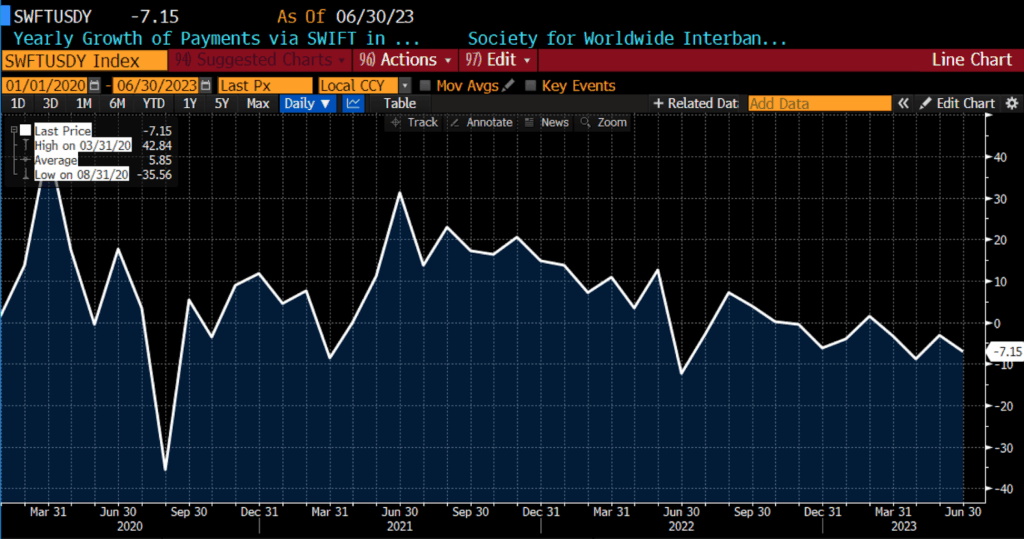

Yearly Growth of Payments via SWIFT in USD, 2020 – present

One of the most noteworthy shifts underlying the dollar’s recent slide has been its emerging role as a funding currency for global carry trades. In an environment characterized by stable but modest global growth, subdued volatility, and a widening divergence in interest rates across economies, investors have increasingly sold dollars to finance long positions in higher-yielding emerging market currencies such as the Brazilian real, Mexican peso, Chilean peso, and South African rand. That dynamic introduces a new class of structural dollar sellers, adding both to downward pressure and to heightened volatility. Becoming a favored funding currency — a role long played by the Japanese yen or Swiss franc — reflects declining confidence in the US growth exceptionalism narrative that once anchored the dollar’s premium valuation.

Yet even as the cyclical bearish case gains adherents, the broader question remains: does dollar weakness equate to de-dollarization? The short answer is: no, or at least not yet. The dollar still accounts for nearly 60 percent of global foreign exchange reserves, more than 50 percent of global trade invoicing, and nearly 90 percent of global foreign exchange transactions. Despite short-term market aversion — for central banks, commodity traders, and multinational corporations — the dollar remains indispensable. Its liquidity, the depth of US capital markets, and the breadth of dollar-denominated instruments such as US corporate bonds, Treasurys, and dollar-pegged financial products continue to make it the default global currency.

Incremental signs of de-dollarization are emerging, particularly in Asia and among members of the expanded BRICS bloc. The Association of Southeast Asian Nations (ASEAN) has actively committed to increasing the use of local currencies in intra-regional trade, aiming to reduce exposure to dollar volatility and geopolitical leverage. Countries such as China, India, and South Korea have increased currency swap agreements, promoted bilateral trade settlements in their own currencies, and repatriated portions of their foreign-held assets. Asian institutional investors, including life insurers and pension funds in Japan and Taiwan, have raised hedge ratios on dollar exposure, gradually shifting portfolio balances toward local currencies.

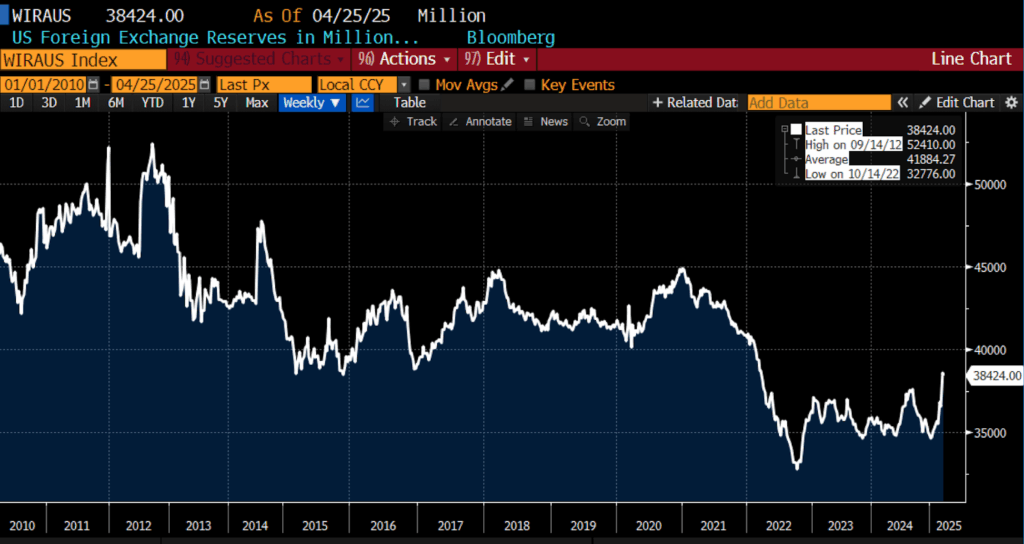

US Foreign Exchange Reserves in Millions of USD, 2010 – present

The BRICS alliance, recently expanded to include members such as Iran, Egypt, the UAE, and Indonesia, has amplified its political push toward de-dollarization. While the group remains economically diverse and geopolitically fragmented, its growing weight in global energy production, trade flows, and financial architecture reflects a strategic ambition to reduce reliance on the dollar. Joint liquidity pools, cross-border payment initiatives, and the creation of alternative commodity trading platforms further illustrate the group’s long-term objectives. Nonetheless, internal frictions within BRICS — particularly between China and India — and the absence of a truly unified financial infrastructure have limited hopes to erode dollar primacy.

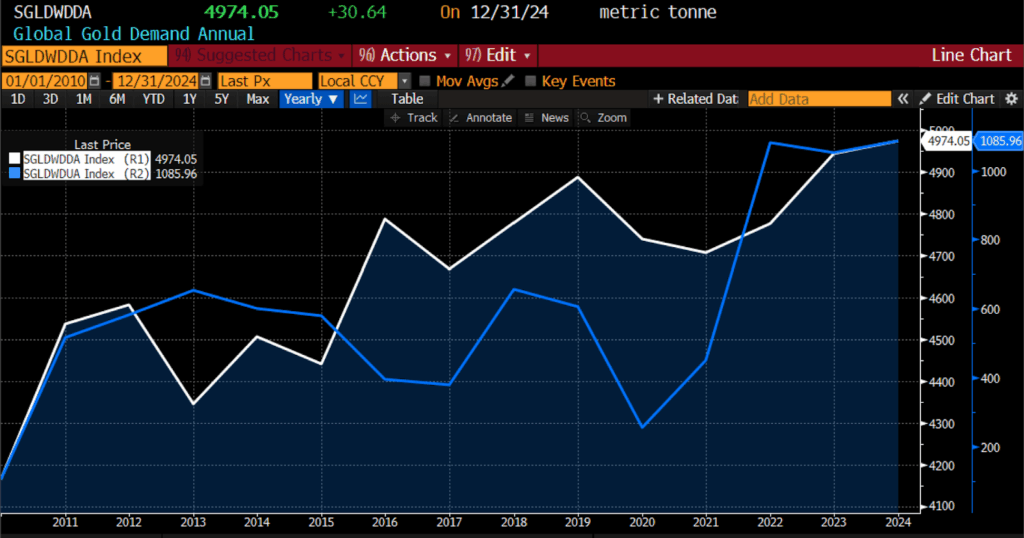

A significant development in the de-dollarization narrative is the surge in official sector gold purchases. Central banks, particularly those aligned with or adjacent to China and Russia, have accumulated over 1,000 tons of gold annually for three consecutive years — doubling the pace of purchases seen in the 2010s. The European Central Bank now reports that gold accounts for 20 percent of global reserves, up sharply from previous levels to eclipse holdings of the euro itself. Meanwhile, the dollar’s share of global reserves has slipped from over 70 percent in 2000 to 57.8 percent in 2024. Gold’s role as a politically neutral store of value makes it an attractive hedge against both inflation and geopolitical risks, particularly in an environment where financial sanctions and reserve asset weaponization have grown more common.

Global Gold Demand (white) & Global Gold Demand Net Central Bank Purchases (blue), 2010 – present

Still, gold’s structural limitations mean that it is unlikely to fully supplant the dollar’s reserve currency functions. Even amid recent turmoil, global dollarization continues in many respects, particularly through the rapid expansion of dollar-based nonbank financial intermediation, dollar-denominated debt issuance, and the technological proliferation of dollar-linked stablecoins.

In sum, dollar weakness and de-dollarization are not synonymous. The recent depreciation of the dollar relative to other currencies reflects a complex interplay of trade disputes, fiscal excesses, cyclical capital flows, and risk sentiment shifts.

True de-dollarization, by contrast, requires the sustained development of viable alternatives that can match the dollar’s liquidity, legal protections, and institutional depth — an outcome that remains distant, though not unimaginable over the long term. While policymakers and market participants should not dismiss the slow, grinding adjustments occurring at the margins, the dollar nevertheless remains firmly entrenched as the central pillar of global finance.

A more sobering truth is this: the greatest threat to continued dollar dominance comes not from external challengers but within. Persistent fiscal indiscipline, rising debt-to-GDP ratios, erratic policy shifts, and the politicization of monetary and financial institutions collectively erode the confidence that anchors reserve currency status.

If that erosion continues, the dollar may eventually cede ground — not through a sudden collapse, but through the gradual accumulation of self-inflicted wounds. In the meantime, the world remains tethered to King Dollar, even as it cautiously explores alternatives.

Read More: