As of December 31, 2025, data for 11 of the 24 components of the Business Conditions Monthly have not yet been published. The timing of their release remains uncertain.

Recent inflation data present a cautiously encouraging picture, though timing differences across measures matter for interpretation. December’s CPI showed underlying price pressures continuing to cool, with core CPI rising just 0.2 percent month over month and 2.6 percent year over year, matching a four-year low after earlier readings were distorted by shutdown-related data gaps and seasonal effects. Shelter costs rebounded modestly and remained the largest contributor to monthly inflation, but outside housing, price increases were notably restrained, with core CPI excluding shelter rising only 0.1 percent and core goods prices flat, reinforcing evidence that tariff pass-through to consumers has been milder and may already have peaked. The Fed’s preferred gauge, core PCE — which reflects October and November conditions rather than December — told a similar, if slightly firmer, story: monthly core PCE inflation slowed into November, annualized measures eased further, and year-over-year inflation held near the upper two-percent range. Beneath the headline, services prices continued to exert some upward pressure, particularly in “supercore” categories, while market-based prices remained comparatively subdued. Taken together, the CPI and PCE data suggest that the disinflation process is intact but uneven, with housing and certain service categories slowing more gradually than goods. For households, this means inflation is increasingly less about broad price acceleration and more about a still-elevated price level, which continues to weigh on perceptions of affordability even as the overall pace of price growth moderates.

Recent labor market data point to a continued cooling in employment conditions, though without clear signs of a sharp deterioration. Job openings fell to 7.15 million in November, the lowest level in more than a year, and hiring slowed further, signaling that employers remain cautious about expanding headcount even as they largely avoid outright layoffs. The decline in vacancies — especially in leisure and hospitality, health care, transportation, and warehousing — has brought the ratio of openings to unemployed workers down to 0.9, its lowest level since early 2021 and a stark contrast to the overheated conditions of 2022. At the same time, layoffs eased to a six-month low, voluntary quits picked up modestly in select sectors, and December data from ADP showed private payrolls rising again after a brief contraction, consistent with a labor market that is softening but still functioning. Announced job cuts fell sharply in December, while hiring plans improved, offering tentative reassurance after a year marked by elevated layoffs and historically weak hiring intentions.

Survey-based indicators from the Institute for Supply Management reinforced this mixed picture, with services employment accelerating to its strongest pace in nearly a year even as manufacturing headcounts continued to contract. Overall, the employment landscape heading into 2026 appears characterized by slower hiring, reduced labor market tightness, and growing caution among employers: conditions that suggest diminishing momentum rather than an outright downturn, but one that remains sensitive to shifts in growth, policy, and confidence.

Conditions in the goods-producing sector remain soft, with manufacturing continuing to lag the broader economy despite some tentative signs of stabilization. ISM data showed factory activity contracting in December by the most since 2024, underscoring persistent weakness in output and demand, while S&P Global’s flash January survey indicated that manufacturing activity improved only marginally and remained near its weakest level since mid-2024. New orders at manufacturers returned to modest growth in January after a brief contraction, suggesting demand may be bottoming but not yet rebounding convincingly. Employment conditions in manufacturing remain under pressure, with headcounts still shrinking, albeit at a slower pace, as firms remain reluctant to add workers amid elevated costs and policy uncertainty. Pricing pressures eased somewhat, but both input costs and prices received remain inconsistent with a rapid return to price stability. Overall, manufacturing appears to be moving off its lows but remains constrained by weak demand, cautious hiring, and lingering cost pressures.

In contrast, the services sector ended the year on notably stronger footing even as early-2026 data point to a more measured pace of expansion. The ISM services index jumped to 54.4 in December, its highest reading in more than a year, driven by robust gains in new orders, business activity, exports, and the strongest growth in services employment since February. Demand was broad-based across key industries such as retail, finance, accommodation and food services, and health care, although commentary continued to reflect unease around tariffs, pricing pressures, and uncertainty. At the same time, S&P Global’s flash January data showed services growth slowing to its weakest pace since April, with new business and hiring close to stall speed as firms weighed high costs and softer demand. While input and output price measures eased modestly, they remain elevated, suggesting inflationary pressures in services are diminishing only gradually. Taken together, services activity has provided an important source of resilience for the economy, but momentum appears to be moderating as the sector enters the new year.

US consumer sentiment improved meaningfully in January, rising to a five-month high as households became more optimistic about both the broader economy and their personal finances. The University of Michigan’s sentiment index climbed to 56.4, its largest monthly gain since June with improvements evident across income, age, education, and political groups. Despite the rebound, overall sentiment remains more than 20 percent below year-ago levels, reflecting continued strain from elevated prices and concerns about a cooling labor market. Inflation expectations eased modestly, with consumers anticipating four percent price increases over the next year and lower long-term inflation than previously reported, even as high prices continue to weigh on purchasing power. At the same time, improved buying conditions for durable goods and stronger views of personal finances suggest households remain willing to spend, helping sustain economic momentum despite lingering affordability pressures.

That cautiously improving tone is echoed on the business side, where small business sentiment strengthened again in December as inflation pressures and labor frictions continued to ease. The NFIB small business optimism index rose to 99.5, driven primarily by a sharp improvement in expectations for future business conditions and a notable decline in uncertainty to its lowest level since mid-2024. Inflation receded as a top concern, with both actual and planned price increases moderating, reinforcing the broader picture of cooling cost pressures seen elsewhere in the economy. Labor conditions were more mixed: hiring plans softened modestly, but job openings remained elevated and fewer owners cited labor quality as their primary problem, suggesting improved balance rather than outright weakness. Offsetting these gains, expectations for real sales growth and capital spending edged lower, leaving the overall outlook one of improving confidence tempered by caution around demand and expansion heading into the new year.

Questions about affordability and consumer strain during the holiday season were partly answered by the January 14 retail sales report, which showed US consumers continuing to spend with notable resilience into the year-end. Retail sales rose 0.6 percent in November, the strongest monthly gain since July, led by a rebound in auto purchases and broad-based strength across most retail categories despite lingering concerns about prices and job security. Excluding autos, sales still climbed a solid 0.5 percent, and the control group measure that feeds directly into GDP posted another firm gain, pointing to continued momentum in goods spending at the end of the year. Holiday promotions, record online sales, and the use of Buy Now Pay Later options helped sustain demand, particularly as higher income households continued to anchor overall consumption while lower income consumers remained more price sensitive. Spending at restaurants and bars also rebounded, suggesting that services consumption retained some momentum alongside goods. While the figures are not adjusted for inflation and therefore partly reflect price effects, recent CPI data indicating that tariff-related price pass-through has likely peaked may help support real goods demand going forward. Taken together, the data reinforce a picture of a still-active but increasingly bifurcated consumer, one capable of sustaining near-term growth even as affordability pressures remain a meaningful constraint for many households.

Also posting a larger-than-expected gain at the end of 2025 was US industrial production, which rose 0.4 percent in December, though the details of the report were less uniformly strong. The bulk of the increase came from a surge in utilities output, alongside gains in nondurable goods and transit equipment, rather than from core investment-heavy manufacturing segments. While overall manufacturing output also surprised to the upside, production of consumer durables and information-processing equipment declined, highlighting continued softness in areas most closely tied to household demand and technological investment. Capacity utilization improved modestly but remains consistent with a manufacturing sector operating below historical norms. Taken together, the data point to stabilization in industrial activity, but a manufacturing recovery that is proceeding slowly and unevenly beneath the headline strength.

Economic activity improved modestly across most of the United States in recent weeks, according to the Federal Reserve’s Beige Book, marking a clear step up from the largely stagnant conditions reported in prior cycles. Growth was described as “slight to modest” in a majority of districts, reflecting a post-shutdown normalization rather than a broad acceleration. Labor market conditions remained stable but subdued, with employment levels largely unchanged and wage growth moderating toward what contacts described as more “normal” rates. Price pressures were generally moderate, though an increasing number of firms reported beginning to pass through tariff-related costs as pre-tariff inventories were exhausted and margin pressures intensified. These findings are consistent with policymakers’ view that the labor market has cooled but remains on solid footing, even as inflation continues to run above the Federal Reserve’s target. Against this backdrop, and following three rate cuts late in 2025, officials appear inclined to proceed cautiously on further easing.

At the district level, anecdotes reinforced this mixed but steady picture of the economy. Some regions reported early signs of improvement in manufacturing demand, particularly tied to data center construction and infrastructure-related investment, while others noted flat activity in transportation and persistent affordability challenges for households. Tariffs featured prominently in business commentary, with firms across multiple districts describing higher input costs, compressed margins, and selective price increases passed on to customers. Labor dynamics were generally balanced, with temporary hiring picking up in some areas and displaced workers often reabsorbed quickly, though large-scale hiring remained limited. Several contacts highlighted the growing use of automation and artificial intelligence to boost productivity, albeit with minimal near-term impact on employment levels. Overall, the Beige Book portrays an economy regaining modest momentum, constrained by cost pressures and policy uncertainty but not exhibiting signs of acute stress.

Several near-term tailwinds are supporting economic momentum, though they are accompanied by growing policy-related uncertainty. Markets continue to price in at least one Federal Reserve rate cut later this year, reflecting a mix of moderating inflation, softer payroll growth, and a still-low unemployment rate, all of which help sustain financial conditions that are not overtly restrictive. Fiscal policy is turning notably stimulative, with new tax deductions and adjusted withholding tables set to deliver a sizable boost to household cash flow and business investment in early 2026. At the same time, regulatory easing and credit loosening, ranging from lower capital requirements for banks to renewed support for mortgage markets, are likely to spur lending and risk-taking. Together, these forces create a powerful short-run growth impulse, reinforcing consumer spending, capital expenditure, and asset prices. However, uncertainty surrounding the Supreme Court’s ruling on Federal Reserve governance has introduced a new risk channel, as any perceived erosion of central bank independence could quickly destabilize rate expectations and financial markets.

Counterbalancing these tailwinds are structural and policy-driven headwinds that complicate the outlook. Trade policy remains a meaningful drag, as evidence shows that US importers and households are absorbing most of the cost of higher tariffs, particularly on consumer goods, autos, and capital equipment, rather than benefiting from offsetting price concessions from foreign exporters. Tariff-inclusive import prices have risen nearly in lockstep with imposed duties, squeezing margins and raising domestic cost pressures even as headline inflation cools. These effects vary by trading partner, but overall they suggest tariffs are acting more like a tax on US firms and consumers than as a lever for foreign burden-sharing. More broadly, concerns about rising public debt, elevated asset valuations, and an increasingly accommodative alignment of fiscal, monetary, and credit policy raise longer-term risks to financial stability. For now, growth is being pulled forward by stimulus and easing conditions, but the durability of that expansion depends on whether today’s policy tailwinds eventually give way to inflation, market imbalances, or institutional strain.

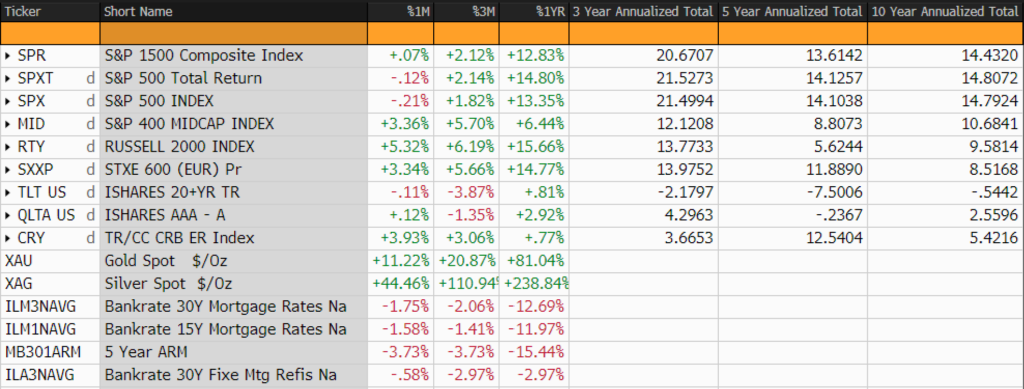

It would be remiss not to mention the astounding run in precious metals over the past thirty days, with both gold and silver posting historic gains amid mounting economic and policy uncertainty. Gold has surged to the cusp of $5,000 an ounce, driven by a powerful mix of falling real yields, fading confidence in fiat currencies, concerns over Federal Reserve independence, and sustained international central bank purchases. The rally reflects a classic “debasement trade,” as investors seek protection from expansive fiscal policy, rising debt burdens, and the perception that monetary restraint is giving way to political pressure. Silver has moved even more dramatically, breaking above $100 an ounce for the first time as haven demand collided with a structurally tight supply backdrop and speculative fervor across global retail markets. Its dual role as both an industrial input and financial asset has amplified volatility, particularly amid trade tensions, geopolitical strain, and shifting expectations around tariffs and monetary policy. Together, the moves in gold and silver underscore a broader erosion of confidence in traditional anchors — currencies, bonds, and institutions — adding a distinct financial market tailwind to the narrative of heightened uncertainty shaping the current economic environment.

Recent economic indicators point to continued forward motion, but one increasingly driven by policy stimulus and financial conditions rather than broad-based organic strength. Consumer spending and services activity remain firm, helped by tax relief, easing credit, and moderating inflation, even as goods production, hiring, and capital investment advance more slowly. Price pressures are cooling, yet elevated living costs and tariff pass-through continue to constrain real purchasing power and business margins. At the same time, questions surrounding trade policy, debt accumulation, and the independence of monetary institutions have emerged as new, more prominent sources of risk. The sharp rallies in gold and silver serve as a market-level signal of that unease, reflecting not recession fear, but growing skepticism about the durability and tradeoffs of today’s policy mix.